Original article here.

Regions With the Most Overleveraged Mortgagers

Posted By Christina Hughes Babb On March 24, 2021, @ 2:35 pm In Daily Dose

The past year—a pandemic plagued one—has proved an interesting time to attempt any major life change, and that includes purchasing a home. Many on-the-fence renters or homeowners looking for more space were prompted by low-interest rates to pull the trigger. There's a solid chance [1] that any recent homebuyer paid more than the asking price, due to supply shortages and increased competition.Those who didn't take all of the prudent measures—including taking the time to boost credit in order to lock in the best possible rates, something the experts at WalletHub, which just conducted a study on overleveraged mortgagers [2], have suggested [3]—might be facing a hint or even a significant sense of buyer's remorse.

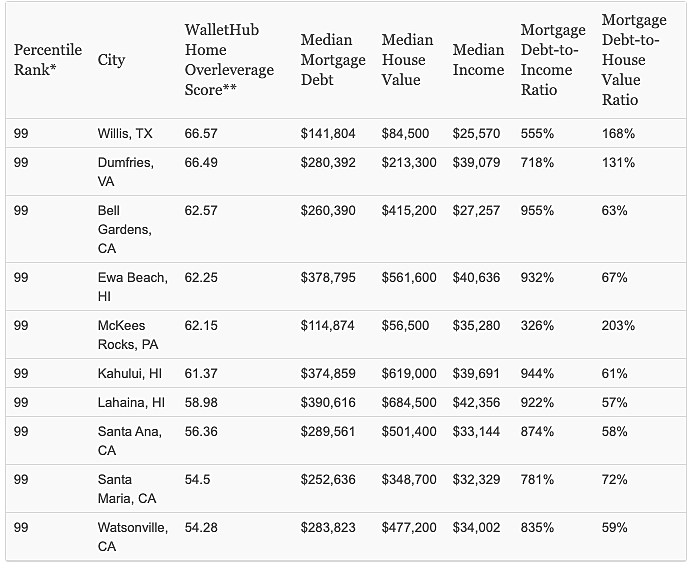

In its report, WalletHub decided which cities are home to the most overleveraged mortgage debtors by comparing the median mortgage balances against the median income and median home value in more than 2,500 cities.

Source: WalletHub [2]

Willis, TX tops WalletHub's list with a 168% mortgage debt-to-house value ratio and 555% mortgage debt-to-income ratio, which led to a high "WalletHub Home Overleverage Score" of 66.57.

Right behind Willis is Dumfries, Virginia, followed by Bell Gardens, California, Ewa Beach, Hawaii, and, rounding out the top five, McKees Rocks, Pennsylvania.

Experts warn about getting caught up in today's low-rate-infused buying frenzy.

"Buying a home is a huge financial commitment for most families. Mortgage interest rates are still historically low, making mortgage payments financially feasible for many households," said Jonathan Halket, Real Estate Fellow at Mays Business School at Texas A&M University. "However, these historically low rates have been priced into many housing markets already—house prices are high. Furthermore, inventory is low, so depending on the market, there may be few choices within your budget. Paying top dollar to commit yourself to a house that is not the one you want to live in just to access a cheap mortgage is probably not a good idea."

Halket has some recommendations for the overcommitted, such as reducing expenses or refinancing, but for someone who just taken on too large a mortgage and will likely never be able to comfortably afford to make the payments, he says, "downsizing as gracefully as possible is probably your best bet. This can be hard to swallow but doing it sooner before you are in deeper financial difficulty, can be key."

While they all concur it's more difficult to do in advance than in hindsight, experts say there are ways to tell if the homes in a particular market are overpriced.

For many of the larger metropolitan areas, the Case-Shiller indexes provide a time trend of housing prices and are available for free on the Federal Reserve Bank of St. Louis’ FRED economic data repository (DS News also regularly reports the Case-Shiller HPI results), shared finance professor Brian Payne.

He says another source of information involves local housing market affordability indexes, which measure housing costs relative to income for local areas. One example is the “Housing Affordability” resource at the University of Nebraska at Omaha website.

Halket also suggests taking a look at rents in the market in question. He says, "If you can rent a comparable property for less than the mortgage payment plus the property tax, then it might be overpriced."

Methodology

In order to determine the cities where people are most overleveraged on their homes, WalletHub first calculated the ratio between the median mortgage debt (based on TransUnion data from September 2020) and the median income in each of 2,530 U.S. cities. Next, we calculated the ratio between each city’s median mortgage debt and its median home value. Our sample considers only the city proper in each case and excludes the surrounding metro area.

Note: The median income for each city is based on the 2019 earnings of individuals aged 16 and older who worked full-time year-round, according to the U.S. Census Bureau's American Community Survey. The figure excludes income from sources other than work.

For each ratio, we determined a score, assigning 50 points to the city with the highest ratio and 0 points to the city with the lowest. For the cities in between, we linearly extrapolated between the two extremes.

We then calculated the overall ranking, or Home Overleverage Score, by adding the two scores. An overall percentile rank of 99, as reflected in our Main Findings, corresponds with the city with the highest total score and therefore represents the “most overleveraged.”

More insights on the topic from several experts are available on WalletHub.

___

Article reposted from DSNews.

Link to article here:

Links in this post:

[1] solid chance[2] a study on overleveraged mortgagers

[3] have suggested